According to CityFibre Chairman Chris Stone, taking the company private will make it easier for CityFibre to access the extra funding it needs to deliver on its stated vision of providing full fibre infrastructure to 20 percent of the UK market.

Fellow altnet and CCgroup client VXFIBER welcomed the news as an endorsement of the opportunity for altnets in the UK to roll out Gigabit-speed broadband fibre in cities and regions not yet covered by the duopoly of Openreach and Virgin Media.

According to Richard Watts, Head of Business Development at VXFIBER, the UK market for Gigabit fibre connectivity resembles a landgrab right now, “Once a provider puts its fibre network into a city, it’s unlikely that the competitors will overbuild it.”

In the FT’s coverage of the CityFibre announcement, analyst Guy Peddy, Division Director at Australian investment bank Macquarie Group, is quoted as saying, “The risk for the UK, is we expected CityFibre to be a vehicle to consolidate the smaller [fibre to the premises] builders in the long term. This consolidation is important to deliver unified platforms for service providers. The disappearance of CityFibre could make this tougher to deliver in the long term in our view.

Presumably, before the takeover news broke, Mr Peddy’s prediction for CityFibre was that it would one day acquire or merge with other FTTP altnets. It would then emerge as a genuine challenger to the current Openreach / Virgin Media fibre duopoly in the UK.

The supposition here is that the growth of CityFibre into a larger telco on a par with BT and Virgin would be a positive move. And perhaps it would be – for CityFibre’s shareholders.

However, CCgroup’s work with VXFIBER shows that large telco incumbents like Openreach and Virgin Media are either unwilling or unable to take on and solve the UK’s lack of full fibre connectivity.

Why else does the UK currently lag behind the rest of Europe in Gigabit fibre rollout?

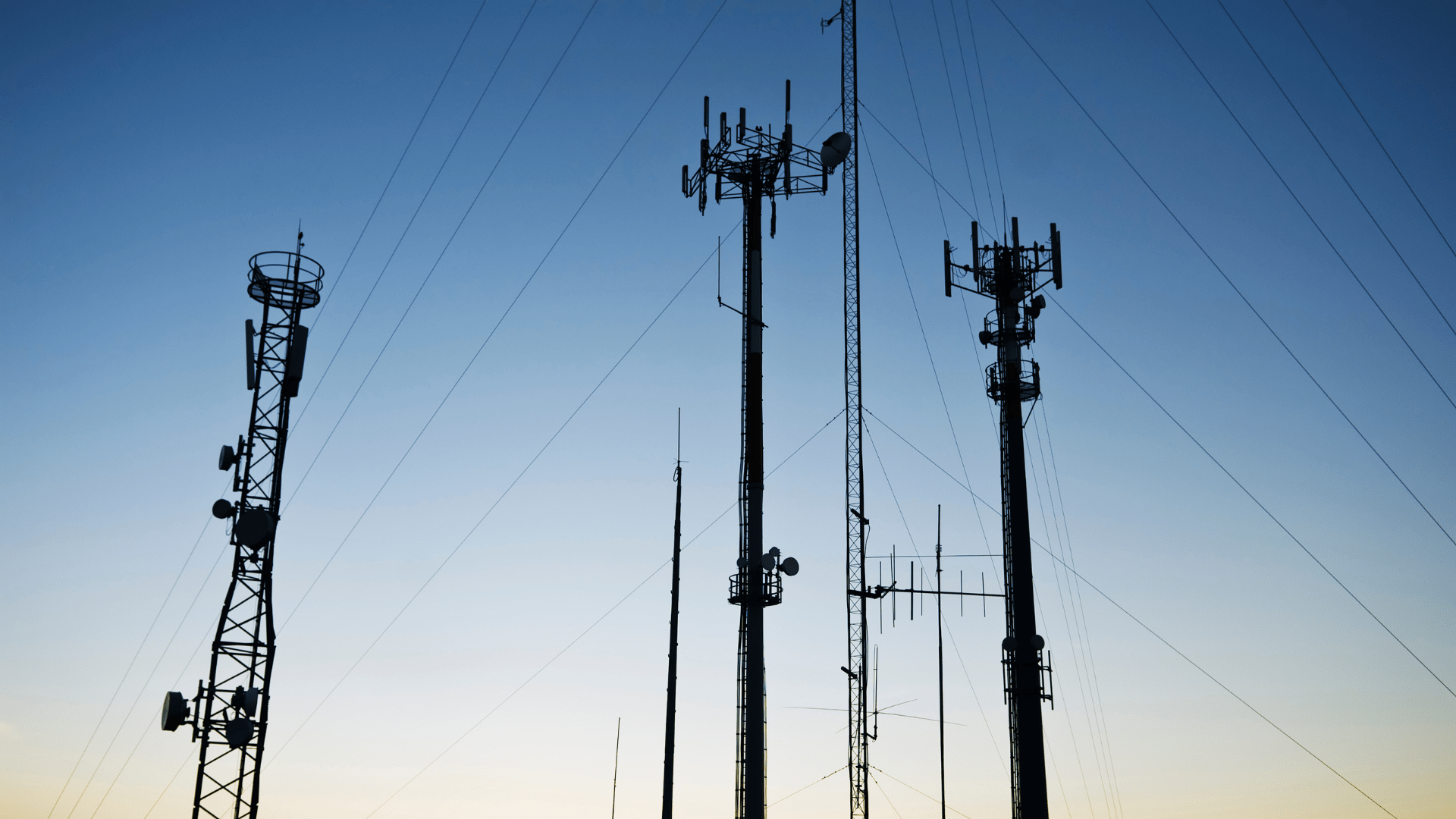

According to Ofcom, in 2017 full fibre broadband was available to just three percent of the UK. The UK also failed to make it onto the Fibre-to-the-Home (FTTH) Council’s European & Global Rankings in September 2017.

Openreach and Virgin Media have both received criticism for the glacial pace with which they’re rolling out full fibre connectivity across the UK. They’ve also focused only on densely-populated urban and suburban areas, at the expense of the UK’s more sparsely populated, rural regions.

Can Openreach and Virgin Media make the argument that for companies of their size, only large-scale fibre deployments in densely populated areas can deliver the returns needed to justify the effort and investment involved in the roll out?

Perhaps. After all, both are divisions of major listed companies (BT and Liberty Media respectively), each with sizeable market caps and each answerable to sizeable shareholder bases. Why invest time and money in expensive fibre installation projects in rural or disadvantaged areas, if the projects might not deliver a return for many years (if at all)?

Viewed in this way, then, the situation could be a case of what’s good for BT and Liberty Media’s bottom line and share price *isn’t* good for the UK’s pressing need for full fibre connectivity.

Therefore, the solution to the UK’s pressing need might lie not with large-scale incumbents like Openreach or Virgin Media: but with smaller independent altnets like VXFIBER, Gigaclear and Hyperoptic instead.

These companies are faster, more flexible and more agile. And they’re not weighed down with the demands and expectations of external shareholders who might be pre-occupied with short term ROI targets.

Might altnets therefore be in the best position to roll out fibre to those sparsely-populated and overlooked parts of the UK that need broadband the most?

Maybe. But how can an altnet afford to install fibre in a city or area that BT or Virgin won’t go near because – in their view – it won’t deliver a worthwhile financial return?

The answer lies in the altnet’s financing and business model. Specifically, the “open access” model in which the altnet partners with a local third party – like a local authority, a property developer or a utility firm – to jointly invest in rolling out Gigabit fibre.

Once the fibre is installed, the third party can work with specialist partners (like VXFIBER) to launch its own ultrafast broadband services for residential and business customers. And it can do so at its own pace, rather than at a pace dictated by shareholders eager for a quick return.

What’s essential is that everybody involved in the rolling out fibre connectivity across the UK – telcos, altnets, investors, partners – bears in mind its long-term economic and social value.

We live in an overwhelmingly digital age. High speed broadband is critical infrastructure that’s as essential as our energy, water, and road and rail networks. The availability of full fibre broadband access in the UK is too important to compromise in favour of short-term profit and keeping shareholders happy.