The fintech landscape is fast changing and so are the topics covered by the media. Using our media listening tools, CCGroup, a Hoffman Agency, conducts a monthly analysis of trending topics to help fintech marketers better connect and communicate in-line with the biggest and emerging topics in the industry.

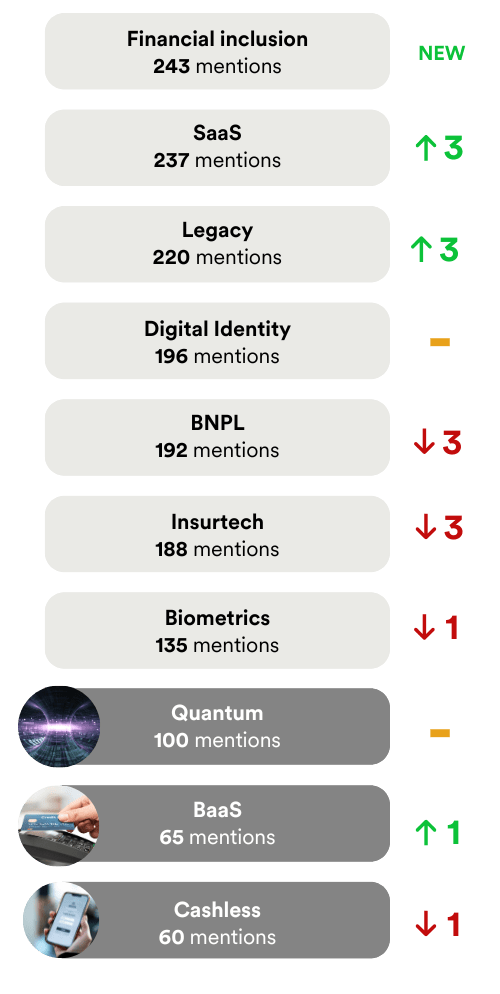

Most popular evergreen themes

We analysed thousands of articles across the fintech media to identify what the most popular topics were in April. Here’s what we found:

Privacy and data entered the top 10 trending topics for the first time, with a 25% increase in mentions. Many conversations highlighting the convergence of blockchain and AI as a key development for ensuring user privacy and data sovereignty. Specifically posts examined the potential advantages of integrating blockchain into public infrastructure, such as the UK or US Treasury, noting improvements in transparency and operational efficiency.

Thunes, Navro, Corpay and Sprive were among a host of fintech announcing new funding as the investment drought continues to wane.

The top three topics remained largely consistent, although mentions of AI and fraud fell by 12% since March. Discussions on blockchain and fraud featured the WazirX crypto exchange’s post-hack restructuring plan which had a major focus in the media. The exchange is awaiting a hearing in May to resume operations and compensate affected users. Notably, crypto hacks caused losses exceeding $2 billion in Q1 2025.

Least popular evergreen themes

On the flip side, the least mentioned topics in the financial trade media covered were:

-Cashless

-BaaS

-Quantum

There has been a lot of movement at the bottom of the table with BNPL, Insurtech, biometrics and cashless all dropping places! Insurtech took a 16% nosedive compared to March with Cashless also dropping further by 19% month-on-month.

On the flip side, legacy systems saw a 28% increase from March. One of the key stories here was RS2 launching an AI-powered orchestration layer to modernise banking legacy systems.

Biggest stories in April

- Tariff Pause – 174 artcilesArticles discussed the impact of tariffs on Bitcoin and the crypto market, with mentions of Trump postponing tariffs and the effect on stock markets.

- CFRB Concerns – 37 articlesThe CFRB’s credit card late fee cap has been thrown out by a federal judge, and overdraft fee rules are set to be repealed after a House vote.

- Global Payments Acquires Worldpay – 24 articles Worldpay was acquired by Global Payments for $24 billion. The merge is expected to create a company serving over six million customers and processing 94 billion transactions worth $3.7 trillion.

- Lloyds Banking Group and Google Cloud – 22 articlesLloyds Banking Group has partnered with Google Cloud to accelerate its AI transformation by migrating its machine learning and generative AI platforms to Vertex AI

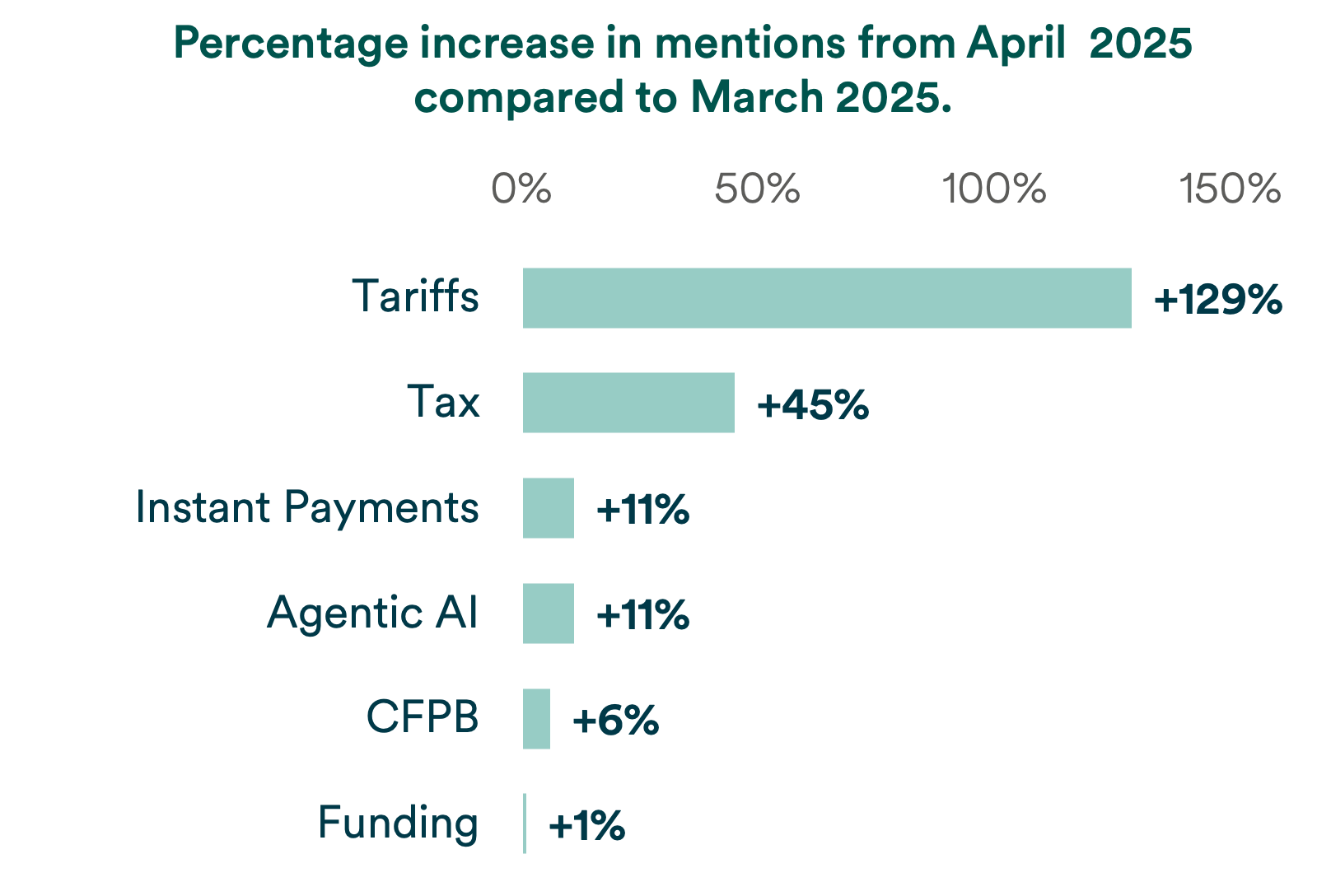

Trending topics

Outside of evergreen themes, here are the emerging trending topics in April.

These topics present timely opportunities for organisations to news-jack and provide commentary on breaking news that is being covered by numerous titles.

Unsurprisingly tariffs had a huge spike throughout April following the latest news from the trump administration. Stories were primarily focused on the impact of US trade tariffs on global markets, including Bitcoin and crypto ETPs. There are discussions about the resilience of Bitcoin and its ability to decouple from stocks. Crypto funds are mentioned for investing in real-world asset tokenization and DeFi projects.

Tax saw a 45% increase in mentions, these were primarily also driven by the discussions around tariffs. Many posts are related to crypto exchanges and their actions, such as restructuring plans, regulatory compliance, and crypto investments.

Some of the key stories across agentic AI include Amazon testing agentic AI and a new agentic AI platform from Bigdata.com.

What’s coming up in April?

- Stablecoins (again): Stablecoins will continue to dominate. We can expect more institutions announcing stablecoin products and partnerships along with commentary around policy makers introducing new regulations around the world.

- Agentic AI: While AI remains the #1 fintech topic, agentic AI specifically will drive the media agenda. Firms will announce agentic AI products, and there will be an ongoing debate around standards, interoperability, safety, and of course, ethics.

- Open Finance: With the CFPB expected to roll back Open Banking rules, we can expect industry debate on the future of Open Finance. They will likely centre on where policy is going, and which markets will lead the re-wiring of consumer finance.

- Tokenization: The shift to tokenizing assets in the capital markets space gathered pace in April and will continue in May. From institutional partnerships to questions over policy, this trend is only set to grow.

- Diversification: Challenger banks and fintech need to diversify their offerings in order to grow. With many big players like Klarna, Revolut and Monzo eying IPOs, expect these firms to announce new products as they position to go public.

Conclusion

AI, blockchain and fraud remain the hottest trending topics. It is critical that fintechs have a view on these developments in order to build relevance to the industry agenda.

Debates around quantum, cashless and BaaS continue to wane. This doesn’t mean they are not important, and worth noting that BaaS has seen a minor resurgence. It’s just that they aren’t as high on the media agenda, which conversely, leaves white space for fintechs that are active in these areas.

Unsurprising tariffs and tax were the emerging trending topics in April. With a jump of over 150% put together, it demonstrates why it’s important to monitor breaking issues and create thought leadership around areas where there is media appetite.