It’s fair to say Money20/20 Europe is the place to be seen as a fintech. The event is high profile, there is strong media attendance and many firms generate significant leads But when it’s all over and marketing teams reflect how well do they understand – what impact did we have? How much did we cut through the noise? How did we compare to our rivals?

To understand this we analysed media coverage at the event last year to understand what good looks like in terms of “noise” at the event, which firms are the leaders and what businesses need to do in order for a brand’s message to be heard.

Understanding the volume

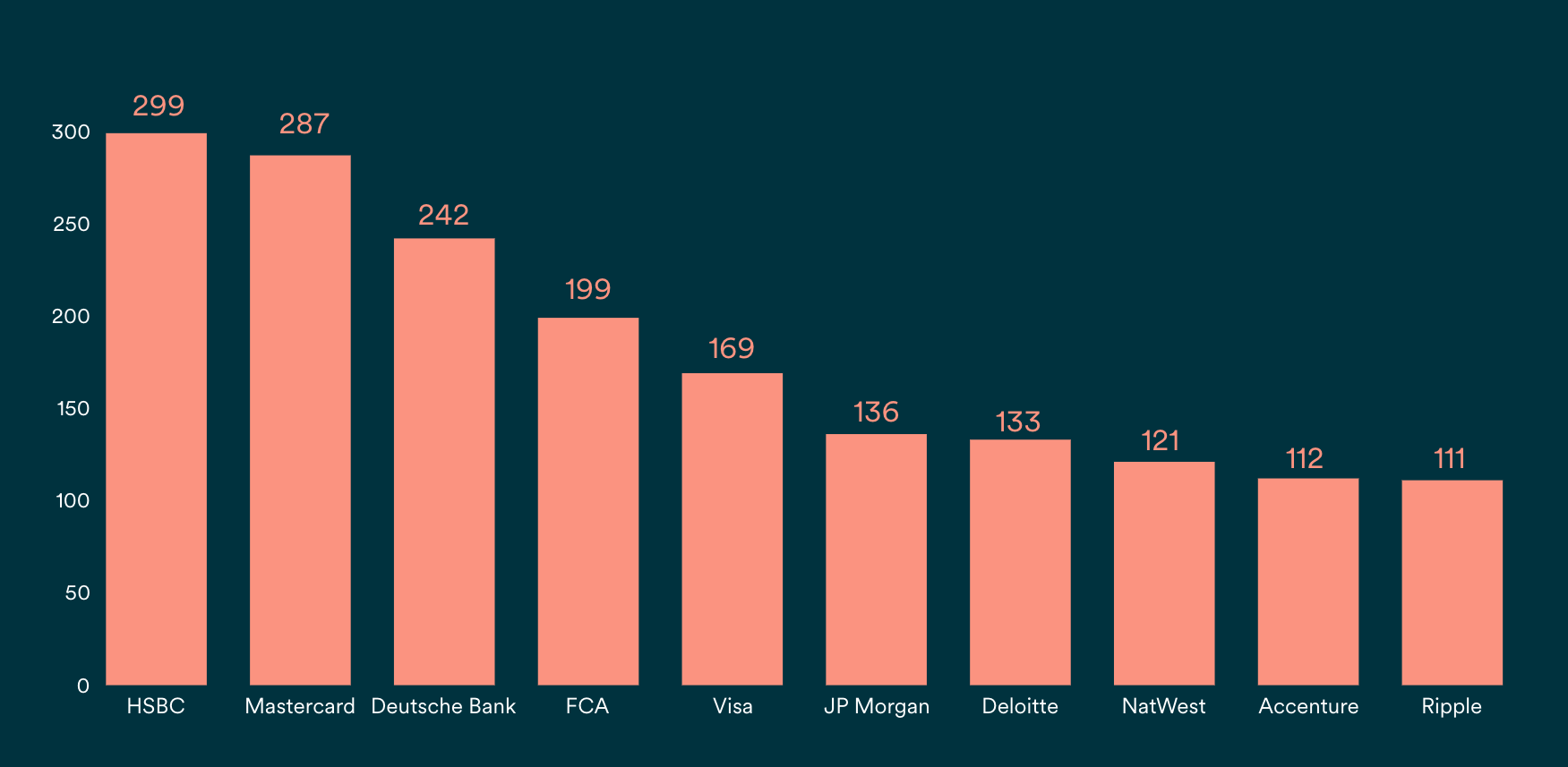

Our research into last year’s attendance tells us that approximately 116 companies were competing for press coverage. Looking at the weeks before, after and during the event there are nearly 1000 articles from these firms littered with new partnerships, product announcements and thought leadership pieces.

On average we found that companies earned seven pieces of coverage. So to cut through the noise a company typically needs to be earning eight to ten pieces of coverage to “break through”.

With that said, volume isn’t everything, quality is arguably more important. Some media coverage will be more relevant or have a wider reach so when reporting internally it’s important to have these considerations. It’s also worth understanding how much the content is engaged with or shared across social media to get an understanding of the real industry impact.

Planning your news

What we know for certain is that news creates coverage. Last year more than 60% of coverage was in relation to news with the topics that drove the most interest being M&A, product announcements or funding for example. Where there is no news companies can create it with many using research as a way to generate coverage. Just under 10% of coverage was generated by using this tactic. Without news success will rely on crafting a good story which is possible but a challenge in the most competitive fintech media environment of the year and you’re less likely to earn high volumes of coverage.

Timing is everything

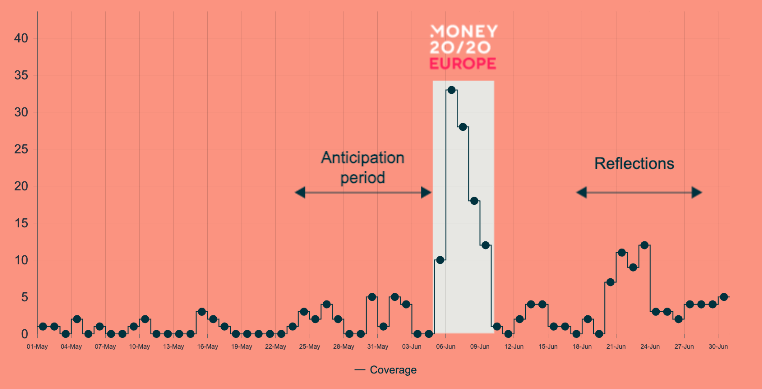

Coverage builds up in anticipation a week before the event and peaks significantly during the show. This tells us that media activity in the build up to Money20/20 is very important as it enables businesses to drive visibility ahead of the event. By doing this companies put themselves on the front foot by setting the agenda and tone for the following week and given sales teams momentum and ammunition to drive sales meetings

Although most coverage about Money20/20 happens over the event period, it isn’t the end of the world if your news doesn’t come out over the week. We found that although coverage builds up in anticipation for Amsterdam it continues to flow for three weeks following the event t. If media content isn’t stellar but strong, taking advantage of the lull the week after is a great strategy.

Who to engage with

Journalists’ time on the ground is precious and they’re more likely to engage with who they know, so building relationships early is important to have the best chance at securing a briefing. In terms of who to target, our research and experience tells us that fintech trade media primarily cover news while national and business media publish a select number of pieces at the event.

As we turn our attention to this year’s event it’s likely that noise levels will continue to grow. We hope that our insights help you to cut through that noise and help you and maximise your presence at one of Europe’s leading fintech events